A recession can lead to business cash flow problems in your organisation, here’s how you can learn to recession-proof your finances with effective cash flow management

Efficient business cash flow management is always important, but in times of recession, it’s essential. Economic slowdowns make it harder to chase invoices, pay your suppliers, or get a bank loan.

So, how can you ensure you have enough cash to stay in business? This post will explore the effects of the recession and explain how to manage your cash flow in a tough economic climate.

What is a recession?

A recession is a sustained period of economic contraction, or negative growth, across a country’s economy. Although official definitions vary, it’s usually described as a drop in GDP lasting for at least two consecutive quarters. Recessions are a natural part of the economic cycle.

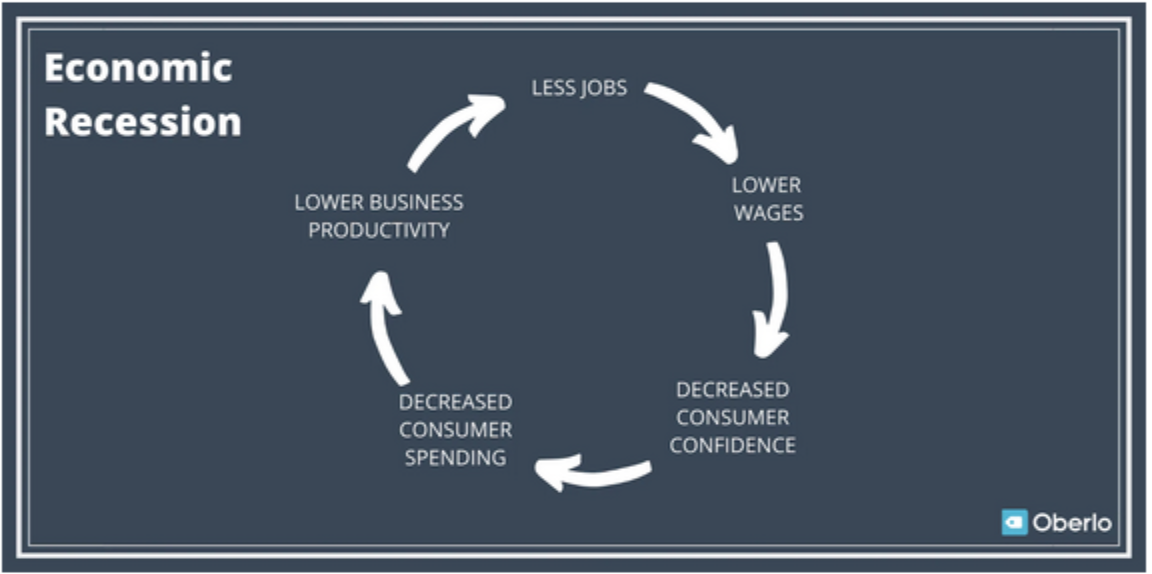

Recessions are characterised by a decline in production and employment and a reduction in consumer spending. With less money circulating, businesses have less money for paying employees, and the government receives less tax from wages to use for public spending.

How a recession affects you and your business

Recessions can cause business cash flow problems, as it becomes more difficult for all businesses to make payments on time. Your customers will delay paying you, with the knock-on effect that you may be late paying your own suppliers.

With consumers spending less, you may also see a decline in profits. You might need to lay off some of your workforce or reduce their wages—which causes concern and low morale among those who remain (especially if they have to pick up the slack).

You’ll also need to minimise overhead costs, and possibly reduce the number of products and services you provide. Your advertising budget will take a hit, and any investment in new products or machinery will have to wait.

If you need to borrow money, you’ll find that lending requirements are tightened and interest rates are higher, especially during a period of inflation. Recessions also cause a decline in the value of stocks and other assets.

How to manage your business cash flow during a recession

92% of business owners don’t have plans in place to manage cash flow during the recession. Don’t be one of them!

Assess your current finances

Start by looking at the current picture. How quickly are you using up your cash reserves? How long before you run out? Identify all your inflows and outflows, and check your cash conversion cycle (the amount of time it takes you to convert investments into cash flow).

If you spot any problems or bottlenecks, consider ways to improve cash flow. For example, keep a close eye on accounts receivable, send invoices out swiftly, and pay off your debts as soon as you can.

Utilize technology for financial management

The best way to manage your business cash flow is to use technology. Automated processes can help you minimise expenses (and errors), and make it easier to collect payments. Accounting software also lets you see at a glance how much money is coming in and out.

If you use invoicing or accounting software online, you’ll be able to track invoices, get notified when they’re overdue, and send automatic reminders. Most accounting software solutions often have useful reporting and analytical capabilities, too.

Reduce expenses and outgoings

Your business will need to tighten its belt during a recession, which may include making hard decisions about staffing. But there are other things you can do, such as operating a remote working model instead of paying for physical premises.

You might also spend less on inventory to avoid tying up your cash and reduce storage costs. If you’ve built strong relationships with suppliers, it may be possible to renegotiate agreements. Take advantage of free marketing, like social media and referrals.

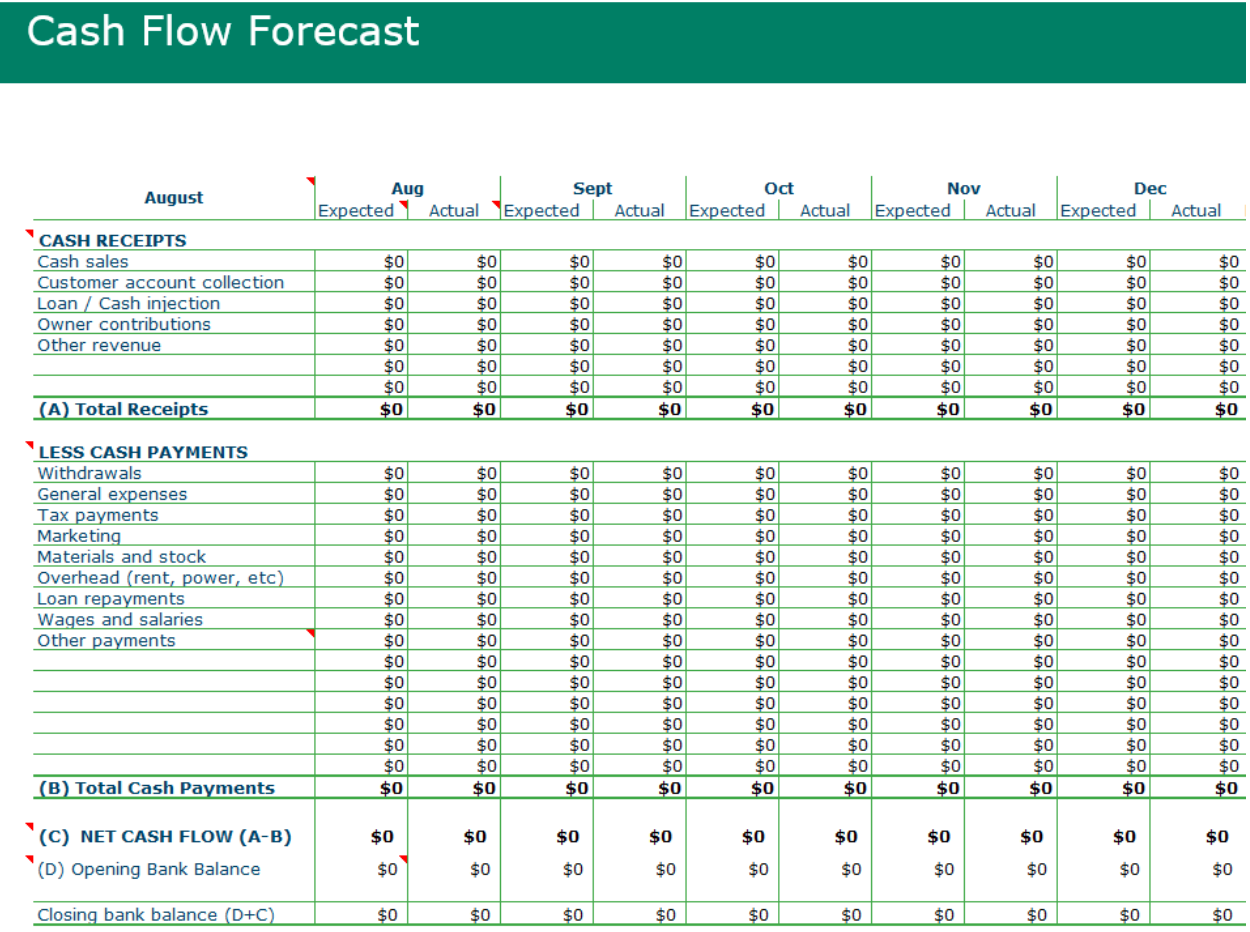

Prepare a business cash flow forecast

Creating a cash flow forecast is crucial for forward planning. It should show the expected inward and outward flow over the next six, 12 or 18 months, and help you to plan for a range of possible scenarios.

Based on the predicted amount of available cash, you can decide whether to cut expenses, and make contingency plans for a continued economic downturn. You should review and update your cash forecast on a weekly basis.

Review and optimize profit margins

It’s also worth looking at your profit margins and finding ways to optimise them. For example, identify your best-selling products and promote them, and consider dropping those that underperform in order to reduce your inventory.

You can also look for opportunities to make more money out of top sellers. Price hikes are risky in a recession, as consumers are also watching their pennies, but you might be able to reduce manufacturing costs or get a supplier discount.

Take advantage of tax deductions

Another way to reduce costs and improve cash flow is through tax deductions. These can include vehicles, travel, machinery, accounting software, advertising, and accountant fees—as long as you use them “wholly, exclusively, and necessarily” for running your business. If you run your business from home, you can deduct a percentage of your household bills.

You can also claim back VAT on business purchases, but rules vary by country, especially if you’re selling across borders. In the EU, you’ll need to claim via the authorities in the country where your business is based. Some EU countries do not allow refunds for certain categories of expenditure, such as restaurant costs and entertainment activities.

As well as knowing exactly what you can deduct, you’ll need to file your tax returns on time to avoid paying a penalty. For example, HRMC’s Making Tax Digital (MTD) scheme makes it simpler for UK businesses and individuals to pay VAT, Income Tax Self Assessment and Corporation Tax.

Set a budget for investments that increases value over time

So far, we’ve looked at ways to minimise costs. But can you build wealth during a recession, and what are the best assets to have? Recessions often bring higher interest rates, so it can be a good time to invest—as long as you set a budget and ensure that the investment will pay off.

It’s sensible to make diverse investments, instead of putting all your eggs in one basket. Try to create a mix of assets that include stocks, bonds, and other investments.

Ensure personal savings

It’s also important to take care of your personal finances during a recession—especially if you’re a business owner. Make sure you look after your savings by delaying high-cost purchases, paying off any high-interest-rate debts, and maintaining an emergency fund. Encourage your employees to do the same, perhaps by offering a financial wellness programme.

Recession-proof your business cash flow

The main thing to remember is that a recession won’t last forever. Think of it as an opportunity to review your finances and operations—and make positive changes that will benefit your business during the good times, too. For example, streamlining processes through automated accounting software, or reducing overhead costs.