Here, we learn about Professor Chien-Feng Huang’s interdisciplinary research at the National University of Kaohsiung in Taiwan, concerning the move towards generalised pairs trading strategies through artificial intelligence

Prof. Chien-Feng Huang has worked on interdisciplinary research and applications across artificial intelligence (AI) and finance in the past two decades. This article addresses Haung’s vision towards utilising AI to construct a generalised approach for pairs trading problems and how Huang regards AI as an excellent opportunity to assist humans in exploring unknown territories in the trading world.

Finance research: Pairs trading

Pairs trading is an important research area in finance that typically relies on time series data of stock price for investment, in which stocks are bought and sold in pairs for arbitrage opportunities. It has been a well-known strategy in the financial markets since the 1980s. It has been employed as an important long/short equity investment technique by hedge funds and institutional investors. (1)

Pairs trading was assumed to be the “ancestor” of statistical arbitrage, which is a trading strategy to gain profit from pricing discrepancies in a group of stocks. (1)

In value investment, traditional approaches mainly rely on the fundamentals of companies to price their stocks. As the true value of the stocks is hardly known, pairs trading models were developed to resolve this by investing stock pairs with similar characteristics (e.g., stocks from the same industry).

The mutual mispricing between two stocks can be formulated by the spread, i.e., the price gap of the two stocks, which is used to identify the relative positions when an inefficient market results in the mispricing of stocks. (2) The results usually lead to market-neutral models, which are uncorrelated with the market and may produce a low-volatility trading strategy.

A typical form of pairs trading operates by selling the stock at a relatively high price and buying the other at a relatively low price at the beginning of the trading period. It is expected that the higher one will decline while the lower one will rise in the future. The spread of the two stocks can be used as a signal to the open and close positions of the stock pairs. During the trading period, the position is opened when the spread widens, and after that, the positions are closed when the spread reverts. This long-short strategy aims to profit from the movement of the spread, which is expected to revert to its long-term mean eventually.

Traditional methods that solve this set of problems typically rely on statistical methods and aim to match pairs of stocks with similar features (e.g., stocks from the same industry).

To gain more insight into this class of financial problems, Prof. Haung has been studying AI-based approaches for solving pairs trading issues more effectively. He aims to develop a generalised approach that can construct trading models for stocks with different characteristics to further improve the performance of trading strategies.

Models for market timing

Huang et al. (3) designed a trading system by constructing models for market timing (e.g., moving averages and Bollinger Bands) that prescribe meaningful entry and exit points in the market, as well as weighting terms that correspond to the capital allocated for each stock in the pairs-trading model. (3) In Huang et al.’s work, genetic algorithms (GA) were employed as tools for simultaneous optimisation of the market timing and pairs trading model parameters.

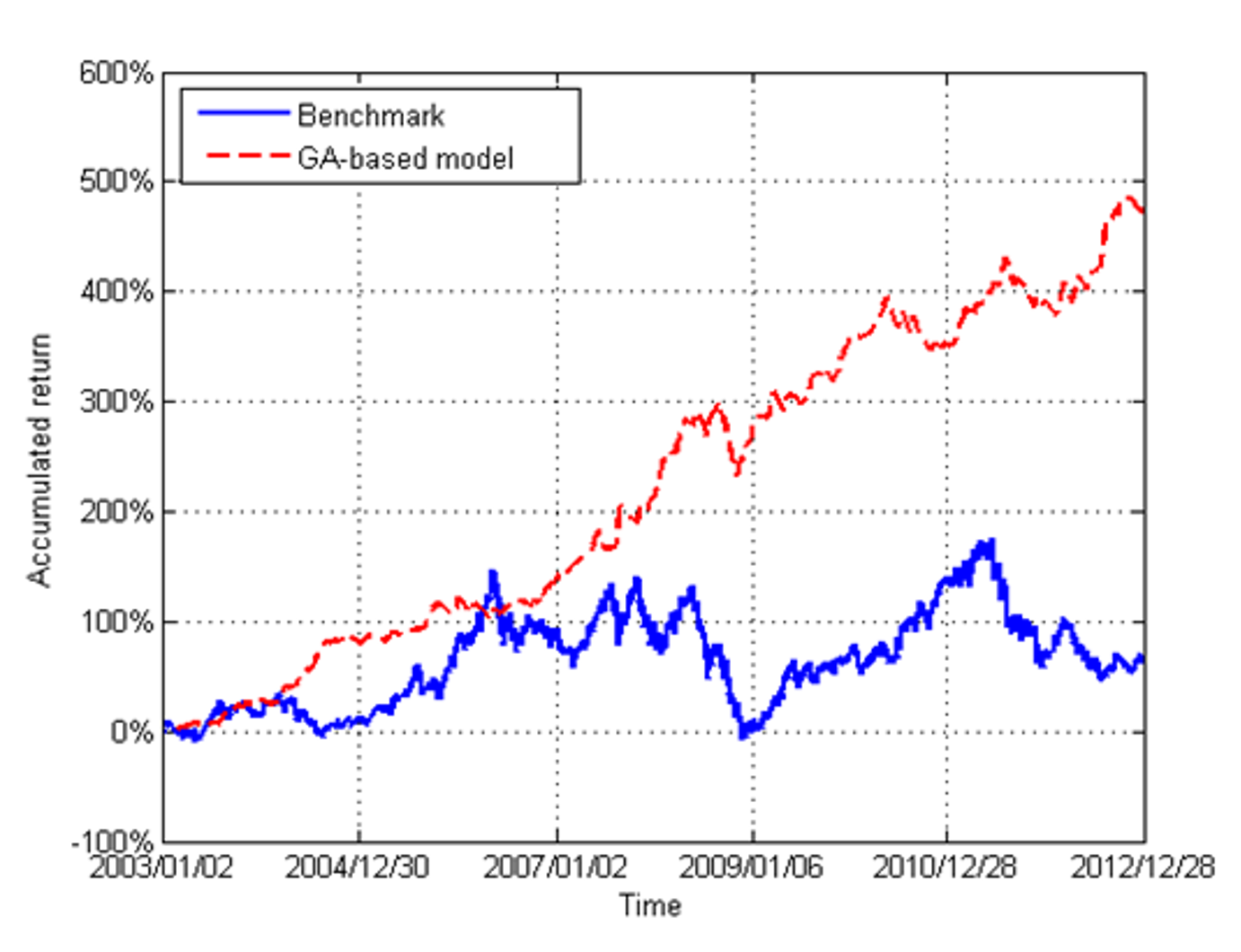

As an illustration, Haung et al. (3) used the ten stocks of the largest market capitalisation listed in the Taiwan Stock Exchange to examine the effectiveness of the proposed method. The following figure in (3) displays the accumulated return of the benchmark and that of Huang et al.’s model. (4)

The figure shows how, instead of the buy-and-hold method, the GA-based model proactively searches for the optimal proportions for long or short positions of each asset to construct the spread. The resultant model gradually outperforms the benchmark, and the performance discrepancy becomes more significant near the end of the investment course.

Huang’s results show that the weighting coefficients for the proportions of capital allocated to stocks, the period for the moving average, and the width of the Bollinger Bands can be optimised by the GA simultaneously. This results in a composite trading system of optimal arbitrage and market timing models. Therefore, these results can show how AI-based methodologies can bring about generalised pairs trading strategies.

References

- N.S. Thomaidis, N. Kondakis. An intelligent statistical arbitrage trading system. Exchange Organizational Behavior Teaching Journal. Springer. (2006) 35454(35483):1-14.

- M. Avellaneda, J.H. Lee. Statistical arbitrage in the U.S. equities market. Quantitative Finance (2010) 10(7): 761- 782.

- C.-F. Huang, C.-J. Hsu, C.-C. Chen, B. R. Chang, and C.-A. Li (2015). An Intelligent Model for Pairs Trading Using Genetic Algorithms. Computational intelligence and Neuroscience, 501(2015).

This study defines the benchmark as the traditional buy-and-hold method where we allocate one’s capital in equal proportion to each stock. The accumulated return is calculated as the product of the average daily returns of the ten stocks where one initially invests all the capital in the stocks and sells all of them only at the end of the course of investment.

This work is licensed under Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International.