Supplies of critical minerals essential for key clean energy technologies like electric vehicles and wind turbines, will need to increase significantly over the coming decades to meet the world’s climate goals

Electrifying road transport is a crucial component of bringing down greenhouse gas emissions and a positive development is consumer spending on electric cars is outstripping government support measures, indicating that drivers are buying electric vehicles because they want them, not just because they were swayed by incentives.

Last year’s increase brought the number of electric cars on the world’s roads to more than 10 million with another roughly 1 million electric vans, heavy trucks and buses.

145 million by 2030

According to the International Energy Agency’s Global EV Outlook, the number of electric cars, vans, heavy trucks and buses on the road is set to reach 145 million by 2030, based on current trends and policy settings. And it could go much higher if governments accelerate efforts to reach international climate goals. However, this will still be a small fraction of the estimated 2 billion internal combustion engines currently in global use running on fossil fuels.

Manufacturing the typical electric car uses 6 times the mineral inputs of a conventional vehicle and an offshore wind farm requires 13 times more than a similarly sized gas-fired plant.

The global clean energy transition will have far-reaching consequences for mineral demand over the next 20 years. By 2040, total mineral demand from clean energy technologies will need to quadruple.

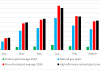

Clean energy technologies require a wide selection of minerals and metals. The type and volume of mineral needs vary widely across the range of clean energy technologies.

Electric vehicles and battery storage will account for about half of the mineral demand growth from clean energy technologies over the next two decades, driven by surging demand for battery materials. Mineral demand from electric vehicles and battery storage will therefore need to increase tenfold between now and 2040.

The significant increase in global demand for these types of technologies, will inevitably lead to significant increases in the greenhouse gas emissions from mining corporations.

What about mining?

As detailed in a previous article, many mining operations are remote and off-grid, meaning almost all of their energy needs are provided by fossil fuels, which explains why the two mining corporations in the top 24 Carbon Majors list, happen to be the two largest mining corporations in the world.

The role of critical minerals in our clean energy transition will come with some very specific challenges to ensure the necessary supplies, such as complex supply chains and the concentration of mining and processing of certain minerals, which are confined to a small number of countries.

The supply chain for many clean energy technologies and their raw materials is more geographically concentrated than that of oil or natural gas. For lithium, cobalt and rare earth elements, the top three producing nations control well over three quarters of global output. In some cases, a single country is responsible for around half of worldwide production. The level of concentration is even higher for processing and refining operations.

This creates significant concerns for companies who produce solar panels, wind turbines, electric vehicles and batteries using imported minerals, as their supply chains can quickly be affected by regulatory changes, trade restrictions or political instability in a small number of countries. Additional concerns have been voiced that such a concentrated geographical focus of critical resources increases the risk of the types of disputes and conflicts we have seen over the last few decades in an attempt to control fossil fuel deposits.

The quantity question of rare minerals

There is also the issue that some of these critical minerals and metals are classified as rare, with no real data to confirm if they actually exist in the quantities that will be required. Confirmed global deposits for nickel, praseodymium, neodymium, cobalt, dysprosium and lithium are currently way below the quantities they will be required to meet the projected demand and will therefore be heavily reliant on new discoveries.

The COVID-19 pandemic has also demonstrated the ripple effects that disruptions in one part of the supply chain can have on the supply of components and the completion of projects.

These concerns will undoubtedly influence the investment decisions of mining and processing companies, which could in turn cause supply and demand imbalances in the years ahead. Despite the promise of massive demand growth, mining and processing companies are already reluctant to commit large scale investment given the wide range of possible demand variances.

What next?

The biggest source of demand variance comes from the uncertainty surrounding announced and expected climate ambitions, where governments have a key role to play in reducing uncertainty by sending strong and consistent signals about their climate ambitions and implementing specific policies to fulfil these long-term goals.

We have already seen governmental ambitions in critical areas of the Net Zero 2050 agenda falling well short in terms of wind, hydrogen and energy efficiency, which explains the lack of trust in governments on the part of mining and processing companies.

It is time for governments all around the world to ensure the targets they set are properly planned, funded and implemented within the time frames they set out, rather than using climate change as a political tool to either garner support from, or deflect criticism from, environmentalist pressure groups and international organisations who have been trying for decades to compel national governments into action.