The interconnected world of fraud prevention and anti-money laundering (FRAML) is continuously evolving, and the stakes are high. This eBook explores the complexities of financial crime, highlighting the rise of fast evolving fraud schemes, cyber scams in particular, and underscoring the importance of effective prevention. We also suggest a technology gap that can be bridged through public-private partnerships (PPP)

This is a strategic guide designed for government agencies at the forefront of this fight against laundering the proceeds of crime. Join us as we explore the emerging risks posed by sophisticated financial criminals, the advanced tactics they use, and innovative solutions to mitigate these threats. Key topics include the importance of data quality, the connection between intelligence and evidence, and the significant role of Moody’s trusted data and analytics tools, like the Grid and Orbis databases and Shell Company Indicator, in transforming our approach to these challenges and staying ahead of emerging threats. The goal is clear: to protect financial infrastructures and deliver national security.

Moody’s, with a strong heritage as a leading risk management expert, offers unique capabilities to help uncover risk factors and support faster, more efficient decision-making while enabling a robust and consistent audit trail.

Chapter 1: The digital frontier – navigating new challenges in public sector fraud and AML initiatives

In the digital age, the landscape of FRAML is not just evolving; it is expanding at an exponential rate. This new era of financial crime brings with it an ‘Infinite Game’ of cat and mouse, where the rules and threats are ever-changing. The first chapter of our eBook explores this dynamic era of exponential risk, emphasizing the need for agility and foresight in the government sector’s approach to fraud and anti-money laundering.

Challenges in compliance and investigations

The increasing sophistication of criminal networks, combined with the rapid adoption of new technologies like cryptocurrency and artificial intelligence, creates a need for investigative techniques and compliance frameworks to be constantly adapted. The sheer volume of data generated by financial transactions and the complexity of cross-border transactions pose a significant challenge in identifying suspicious activity. Balancing robust AML measures while protecting privacy rights and facilitating legitimate financial activity can also be delicate.

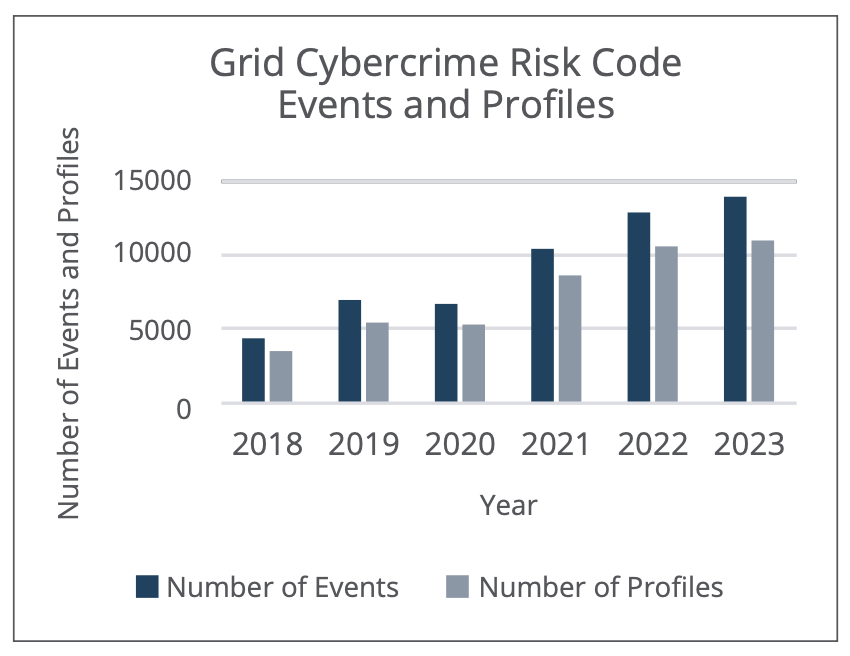

The rise of cybercrime and ransomware

As cyber threats loom large, we remember the vulnerabilities inherent in supply chains. Even organizations with robust security measures are not immune to the domino effect from an attack on a supplier. In this context, the role of predictive analytics and risk assessment becomes vital to resilience.

The graph shows data from the Grid database between January 1, 2018 and December 31, 2023. It illustrates the increases in profiles and events associated with our cybercrime risk code (CYB).

Tax crime and regulation: emerging trends in the digital landscape

- Article:

- NRRP anti-fraud measures intensify across the EU. COVID-19 relief funds have attracted financial criminals and caused immense pressure on government agencies. Effective use of high-quality data and technology can help streamline due diligence processes for proactive defense.

- Whitepaper:

- Integrating tax crimes in financial and economic crime prevention control frameworks. A comprehensive analysis of the current state of tax crime and regulation. Looking at trends that have emerged in the wake of digital transformation and globalization. Offering insights and strategies designed to empower detection and prevention to combat illicit activities effectively.

The role of public-private partnerships (PPP)

Detection and enforcement often require investment in technology and expertise. As public sector resources can be limited and under scrutiny; there is an opportunity for public sector agencies to collaborate with the private sector – addressing these evolving threats in partnership. By doing so, governments can expect to benefit from new perspectives from partners that are at the cutting edge of applying advanced technological solutions.

A call to adaptation

To preempt potential threats, we encourage organizations to foster a culture of preparedness and early mitigation. Using data-driven insights and new technology can give government agencies a strategic advantage and identify vulnerabilities before they are exploited.

A proactive stance enables strategic planning and targeted mitigation efforts, which are essential in an environment where resources are often limited.

We see three important takeaways:

- Prioritizing resources for early risk detection is crucial for effective strategic planning.

- Data is paramount. But it must come from trustworthy sources and be governed in the right ways.

- Cyber risk is one of many interconnected risks and a broader assessment approach can help build resilience.

As government agencies worldwide engage with the challenges of cyber security and other evolving risk types, Moody’s stands at the forefront, offering the insights and tools to decode risk and unlock opportunity.

Chapter 2: The devil is in the data – the importance of data quality

In the FRAML battle, data transcends its role as an instrument; it emerges as a force for good. This chapter focuses on the transformative role of good quality data in enhancing governance and culture within government agencies to combat anti-money laundering and fraud.

The pillars of excellence: clean, high-quality, and trustworthy data

Trustworthy data is pivotal for artificial intelligence (AI) development and deployment; emphasized by the European Union’s AI Act and the Organization for Economic Co-operation and Development (OECD)’s guidance on exploitability and data integrity.

Clean data is accurate, complete, and free from error or duplication, ensuring AI systems are trained on datasets without misleading inputs. Good quality data encompasses relevance, diversity, and representativeness, allowing AI models to generalize across various scenarios.

Trustworthy data maintains integrity and security, respecting credibility, privacy, consent, and ethical standards, upholding the AI system’s reliability. These factors are interdependent, ensuring AI systems are ethical and fair.

Addressing data challenges in AI scraping practices

Maintaining data integrity using AI-driven data scraping presents various challenges. First, AI can introduce errors during data extraction, transformation, or loading processes, leading to inaccuracies in the dataset used to identify risks and make decisions about suspicious activity.

This is exacerbated by dynamic data sources that update frequently, making it difficult to differentiate between outdated and current information.

Second, legal and ethical issues arise when scraping websites, as AI can bypass protections, raising privacy and consent concerns. Finally, inconsistent data formats from various sources complicate integration and undermine data quality. Balancing AI capabilities with legal, ethical, and quality standards is essential for effective data scraping and confident decision-making.

Moody’s: At the forefront of data-driven solutions

Moody’s is a leading expert in providing high-quality data with trusted connectivity. Through tools such as the Grid and Orbis databases, we offer the tools and insights necessary for effective governance in the digital age.

Our advanced analytics and robust datasets can empower organizations to stay ahead of the curve in detecting and preventing financial crime with data that is clear and reliable.

Our data quality process includes:

- Cleansing:

- Correcting errors and inconsistencies in the data, such as duplicate records or typographical mistakes, to enhance accuracy.

- Standardizing:

- Harmonizing data from various sources into a uniform format for coherent access and comparative analysis.

- Enriching:

- Augmenting data with additional information from external sources to provide a fuller context and analysis.

Chapter 3: The intersection of intelligence and evidence in financial crime prevention

This chapter advocates for ‘augmented intelligence’ in FRAML. Robust data is a prerequisite. But to deal with the complex financial crime risks of today, we need more than just clean, high-quality data. We need evidence to turn that data into intelligence and action.

A unified front against financial crime

Cyber criminals have been quick to embrace the digital transformation. Their digital skills often surpass those of the authorities, who may face limited funding and resources. The private sector generally has more financial and operational flexibility, allowing them to develop and adopt innovative solutions. Collaborating with these firms offers access to their advanced technology and could enhance investigations with the additional evidence they can gather; for example, using digital forensics.

“With 80% of crimes having a digital component, law enforcement and the judiciary need swift access to digital leads and evidence. They also need to use modern technology and be equipped with tools and skills to keep up with modern crime modi operandi.” – European Commission, 2021.

The role of AI and machine learning in enhancing intelligence efforts

AI and Machine Learning (ML) can significantly enhance government FRAML efforts by processing and analyzing large datasets quickly to identify patterns and anomalies that might indicate fraudulent activity.

AI can enhance precision in fraud prevention, detecting irregular patterns and behaviors by continuously learning from historical data and decisioning. ML models can adapt to new and evolving fraud tactics, ensuring prevention mechanisms remain robust over time.

AI and ML can also streamline compliance processes, automating the due diligence workflow against regulatory requirements to enable decision-making and reduce manual intervention. This not only accelerates the ability to complete suspicious activity reports, but also optimizes investigative resources, focusing human expertise where it is needed most.

In essence, the integration of AI and ML into fraud prevention and AML efforts represents a significant step forward for government agencies and departments, offering a more proactive, efficient, and effective approach to safeguarding financial systems against illicit activities.

- Read:

- Navigating the AI landscape: insights from compliance and risk management leaders. Moody’s has conducted an extensive global study into attitudes, adoption, and use cases for AI in the world of risk management and compliance. Looking at the different forms of AI from machine learning to GenAI, we investigated what professionals across the globe understand about this technology and how they perceive possible benefits, risks, and outcomes.

- Learn more:

- Moody’s intelligent screening solutions. Harness the power of AI and machine learning to automate risk and compliance screening. Process alerts with consistency and accuracy. Get more precise results and a significant reduction in false positives. Identify risks in your counterparty network using intelligent screening and mitigate issues before they become a problem.

Chapter 4: Advanced investigations and shell company indicators

Decoding complex business structures and identifying beneficial ownership & control

Thorough investigations for fraud prevention in the public sector are crucial for maintaining integrity and trust in public institutions and for safeguarding public funds. These investigations can be complex, involving convoluted business structures designed to obscure ownership, control, and the flow of illicit funds. To effectively decode these structures, investigators employ a multifaceted approach that combines forensic accounting, legal analysis, and advanced data analytics. Identifying ownership and control requires digging through layers of corporate structure, often spread across multiple jurisdictions, and using public and proprietary databases to trace connections and understand the legal control mechanisms.

By taking advantage of specialized resources, public sector investigators can enhance their ability to conduct thorough due diligence, risk assessment, and fraud investigations, ultimately contributing to a more transparent and accountable financial system.

With extensive financial databases and analytical tools, Moody’s can offer invaluable support in creating corporate transparency around ownership and control. Assessing credit risk, analyzing complex financial structures, and providing detailed company reports can aid investigators in understanding the corporate structure and risk profile of an entity under scrutiny. Our databases can help trace the interconnections between entities, revealing hidden relationships and identifying beneficial ownerships. Our expertise in risk screening and profiling can also assist in identifying anomalies that may signal entities associated with fraud, supporting the broader efforts to prevent the reintegration of illicit funds into the economy.

The enigma of shell companies

- Read:

- Detect shell company risk. Shell companies can be used to disguise illicit activities and the money generated from them. It is difficult and time-consuming to identify patterns of shell company risk. Our Shell Company Indicator uncovers hidden risks related to shell companies through insightful, typology-driven flags during customer/third- party onboarding and investigations for better and faster decisions.

Moody’s technologies: uncovering hidden risks

- Case Study:

- Identifying shell company operations through a sanctioned by extension entity (Page 5) With the increasing complexity and sophistication of sanctions evasion techniques, direct screening of entities against OFAC’s Specially Designated Nationals and Blocked Persons list (SDN list) is no longer adequate. There are instances where sanctioned entities take advantage of loopholes to use legal persons as a vehicle to evade detection. For financial institutions to mitigate the potential risks posed by the abuse of using legal persons, it is vital that their compliance teams discover potential shell companies within their client portfolio, as well as conduct due diligence on all counterparties in transactions.

Chapter 5: Navigating the future of fraud prevention and AML

Emerging technologies: the new frontier

Blockchain, AI, and ML are at the forefront of a technological revolution in FRAML. These innovative tools offer government agencies unparalleled opportunities. Blockchain’s immutable ledger can deliver transparency and security in transactions. AI’s advanced algorithms enable the detection of irregular patterns and behaviors. And ML’s adaptive models continuously evolve to flag new fraudulent tactics. Moody’s is leading the charge in integrating these innovations, enhancing our solutions to combat financial crime more effectively. Our commitment to digital transformation, innovation, and regulatory readiness positions us as a trusted partner for government agencies worldwide, ensuring a proactive stance against fraud in an increasingly digital landscape.

Collaboration: A united front against crime

The fight against financial crime is not one to be waged alone. Throughout this eBook we have highlighted the importance of collaboration between government entities and the private sector. Successful partnerships can enhance the effectiveness of fraud prevention strategies through access to technology and expertise. The need for continuous adaptation and the adoption of advanced tools and methodologies have never been more important to stay ahead in the dynamic field of fraud prevention.

As we reach the end of our exploration through the complex landscape of financial crime prevention in the public sector, we reflect on the critical themes that have emerged throughout this eBook. The importance of prevention and mitigation, the power of high-quality data, and the transformative impact of digital innovation have been recurring themes.

The imperative of effective prevention

A holistic understanding of risk remains the cornerstone of effective fraud prevention. By identifying risks associated with individuals or entities, government organizations can safeguard their finances, assets, and reputations.

The role of high-quality data

High-quality data is the lifeblood of understanding risk and relationships. It empowers government teams and departments to make informed decisions, uncover hidden risks, and stay ahead of crime. Moody’s solutions harness the power of data to drive innovation and efficiency in fraud prevention strategies.

Embracing the digital evolution

The digital evolution is reshaping the financial crime landscape. As we have explored, emerging technologies offer new avenues for fraud prevention. Moody’s is committed to using these technologies to enhance our solutions and support customers in navigating this era of digital transformation.

Navigating a web of integrated risks

This eBook has highlighted the evolving challenges and integrated risks the public sector is facing, and the need for a holistic approach to risk management. As we look to the future, we believe that if governments and organizations adopt new technology solutions and embrace the opportunities presented by public-private partnerships, it offers an opportunity to forge a more resilient defence against financial crime.