Gabriel A. Giménez Roche, assistant professor of economics at NEOMA Business School, discusses what economic consequences we can expect as a result of the COVID-19 pandemic

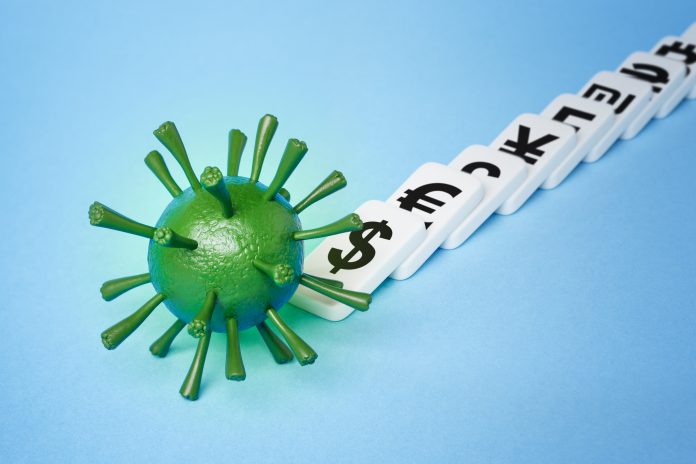

After the current coronavirus crisis with its quarantines and other shutdowns of global economic activity, what can we expect as consequences? Could we face a crisis similar to that of 2008, or even worse? Is the fall in the stock market a sign of the coming recession or a reaction of hysteria in the face of the virus?

Cash flow

Firstly, to understand the relationship between the current COVID-19 crisis, stock markets and real economic activity, we need to understand the logic of cash flow. Companies need long-term funds in order to initiate their projects and short-term funds to undertake their regular operations during an annual exercise. For a healthy company, if the financial capital can sufficiently come from internal funds, like the contribution of equity from its shareholders and founders, as well as from external funds, like debt, operational capital or cash must come regularly from the net revenues of its activity.

Obviously, sometimes a company has to go into debt in the short term due to a shortage of cash, but for a healthy business, this is punctual and involves very short-term debt, often a few weeks to a few months. A business that is unable to generate positive cash flow on a sustained basis is one that will be unable to meet its long-term obligations and will, therefore, have to close its doors.

Therefore, it is clear that it is corporate cash flows that form the foundations of the entire global economy. If this liquidity circulates, the whole system is doing well. Of course, sometimes this liquidity concentrates more on certain players than on others, which explains the existence of financial markets, where promises of repayment will be exchanged for liquidity. Some of these assets are more liquid, that is, can be more easily sold than others. In any case, the more liquidity circulates in an economy, the more liquid the markets for securities are, which makes it easier for businesses and investors holding such assets to obtain liquidity if needed.

Unfortunately, the COVID-19 crisis caused by the coronavirus pandemic has resulted in a more or less great halt in productive activity and therefore in the commercial operations of companies. They are therefore unable to generate cash flow, which then leads them to liquidate their assets to meet their obligations. However, this cessation in liquidity circulation occurs massively which then puts in check the very liquidity of the financial markets, which then find it difficult to provide liquidity to companies. Those players with liquidity surpluses do not let go of their funds, while those with liquidity deficits default on their liabilities with all the consequences that this can have on the real economy: rising unemployment, lower consumption and reconsolidation of projects.

What does this mean for the economy?

The first and inevitable consequence will be a recession. Because even if activity resumes after the end of the health crisis, the prolonged lack of activity will cause a significant cut in the generation and circulation of cash flows that will not be remedied just by a resumption of operations. Given the situation, banks will drastically reduce their credit supply, which will pose a problem for a rapid recovery in investment.

Central banks around the world know this and have already announced their commitment to inject liquidity into the markets, but this injection is for the moment blind, since it remains to be determined which sectors will need it most when the time comes. In addition, the announced injections may prove to be insufficient, as the magnitude of the coming economic recession will largely depend on the duration and reach of the current health crisis.

No matter what measures are taken at the dawn of the coming recession, there will be long periods of economic turmoil. Nevertheless, it is obvious that exceptional measures, never seen since the 19th century, are to be expected. This may involve company rescues and injections of liquidity that will be done in urgency and, therefore, the targeting criteria will not be optimal, thus resulting in distortions, where companies previously in bad condition receive too much funds while companies in good condition receive little funds.

As well as this, we may see more or less temporary nationalizations, both partial and full, of companies, in particular those “too-big-to-fail,” like airline companies, utilities, etc. As a result, the level of public and private debt will make an increase in interest rates even more distant, which neutralizes a banking tool for controlling debtors’ risk.

If the worst is avoided however there is the potential that the economy will restart with much more liquidity available than before (provided by desperate central banks), which will allow banks to revive credit from a base that is far too high than todays. If credit restarts on an even higher basis than the current one, the rise in prices of financial and real estate assets will resume, as well as debt for education and consumption. This may lead to further inequalities in wealth which will therefore tend to widen thanks to the rescue intervention but not thanks to the “market”.

But can the worst consequences and structural distortions be avoided? Yes, if a government takes advantage of the subsidy from central banks to rebalance its budget, reform its taxation, soften its bureaucracy and adopt strict rules of budget responsibility. All this tends to reduce public debt and therefore the incentive to revive bank credit too quickly. But this solution, at least in Europe, requires a level of supranational concertation that is unthinkable for the moment.