New research carried out by the Nuffield Trust highlights the growing staff crisis in the NHS with the first sustained fall in GP numbers in half a century

While there are a number of factors driving this, including training, stress and burnout, it is a situation that leading financial planning firm Tilney believes is being exacerbated by the unintended consequences of measures implemented to limit the cost to HM Treasury of pension tax relief.

The effect of pension tax complexities on doctors and consultants is an issue that has been steadily gathering attention. Matthew Hancock, Secretary of State for Health and Social Care, admitted earlier this year that tax charges on pensions were “the biggest concern I have raised with me by GPs”.

Concern over the effect of pension taxation on senior medical professionals has grown further in recent weeks after the Acting Chair of the British Medical Association Consultants Committee, representing all consultants in the UK, wrote to the Chancellor Phillip Hammond expressing serious concerns about pensions tax charges.

The BMA consultants committee warned that to avoid annual allowance tax charges: “consultants must limit their income, and in most cases, this means stopping doing regular overtime in the form of additional programmed activities”.

Gary Smith, chartered financial planner at leading wealth management group, Tilney comments: “Successive and ill-considered tinkering with the pension allowances to limit the cost of pension tax relief to the Treasury is undoubtedly a factor fuelling early retirement by doctors with two thirds of GPs now retiring early, double the level seen just five years ago.

“At Tilney we have seen a sharp rise in both the number of GPs and consultants seeking specialist financial planning advice as a result of being impacted by more complex pension allowances which can land them with punitive tax charges and this is causing considerable anxiety. The issues and circumstances for GPs and consultants differ but ultimately stem from two changes to the pension allowances.

“First, and foremost, was the introduction of the tapered annual pensions allowance on 6 April 2016 and secondly, successive, sharp reductions in the Lifetime Allowance from £1.8 million in 2011/12 to a current level of £1.055 million.

“The tapered annual allowance is incredibly complicated and highly punitive for those subject to it, as most senior medical professionals are. While for most people the annual gross pension allowance is up to £40,000 a year, those whose total earnings from all sources are above £150,000 see their annual pension allowance reduced down from £40,000 on a sliding scale by £1 for every £2 earned above this threshold to as little as £10,000. Those exceeding this hard-to-understand allowance are then subject to hefty and unwelcome tax charges.

“The dramatic cuts to the Lifetime Allowance also have significant implications for those with higher value pension schemes. Pensions valued over and above the Lifetime Allowance at the point at which benefits are taken are subject to a 55% tax charge on the excess.

“These allowances and tax charges are especially hard to navigate for members of defined benefit pension schemes, like the NHS Pension scheme, where pension benefits are linked to final salary levels rather than ones where explicit contributions are being made into a pension investment fund. We find many of our senior medical professional clients utterly confused by this complexity.

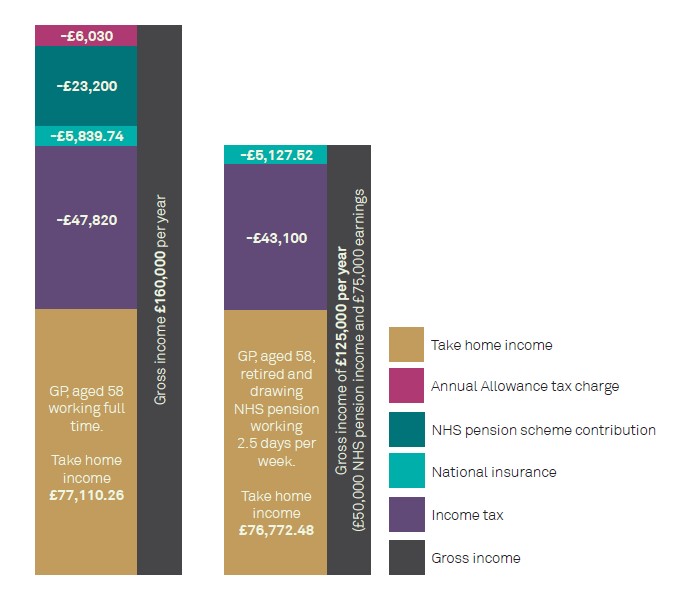

“The effects of these changes to the pension allowances is quite perverse. As our illustration below shows, a GP retiring early and working half a week as a locum is now barely worse off than one working full-time on double the hours. In my experience advising many senior medical professionals, they are typically very committed to the NHS and passionate about their work and most would prefer not to retire early or have to weigh up their working hours against tax implications, but the absurd economics of the current pension allowances is driving them to this.”

Tilney compares the financial positons of a GP, aged 58, working full-time with a pre-tax income of £160,000 with that of a GP of the same age, who has taken early retirement and is drawing an NHS Pension income of £50,000 and working 2.5 days a week as a locum earning £75,000. After income tax, national insurance and pension tax charges are taken into account, the part-time GP has an annual take-home income just £338 lower than the full-time GP, despite working half the hours.

Source: Tilney.co.uk