The current economic situation, marked by soaring inflation, is significantly impacting student mental health and worsening the ongoing crisis among young people

With rising living costs and crippling student debt, young people struggle to handle mounting financial responsibilities, leading to heightened stress levels and mental health issues.

A recent Studocu survey highlights the widespread effects of this issue and emphasizes the need for society to address student mental health during these challenging times.

By recognizing these harsh realities and exploring solutions, we can better support students in pursuing their dreams and achieving academic success amidst an unstable global economy.

Let’s look at what lies beneath those daunting financial headlines and see what hope there might be for a brighter future in 2023.

A brief overview of the current economic situation and its impact on students

Student mental health suffers due to rising inflation and stagnant wages.

As tuition rises, students must work multiple jobs and take out loans to pay for necessities. A study resource platform, StuDocu, surveyed students about inflation and mental health.

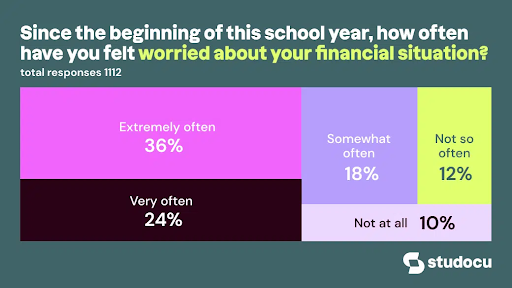

75% of respondents had financial problems, and 65% were depressed or anxious.

75% of student respondents had financial problems

This emphasizes the urgent need for policymakers, educational institutions, and communities to address economic factors and student mental health and well-being.

By studying how inflation affects students’ mental health, we can better support them during economic uncertainty and ensure their well-being.

The effects of inflation on student mental health

The surge in inflation significantly impacts college and university students’ financial well-being and mental health.

Rising living costs increase pressure for students to work more, causing stress, anxiety, and burnout as they juggle academic and financial responsibilities.

Inflation’s uncertainty also affects their prospects and may force them to prioritize financial security over their passions, leading to later dissatisfaction.

Thus, it is essential to recognize the connection between inflation and the student mental health crisis and explore relevant statistics to address this issue.

In light of this understanding, let’s explore some statistics showing what percentage of students report worsened mental health due to inflation-related factors.

Percentage of students reporting worsened mental health due to inflation

As inflation rises, more students are reporting worsening mental health issues.

As they struggle to pay for college, many students are experiencing increased stress, anxiety, and depression.

Many students experience mental strain from working longer hours or taking on additional jobs to make ends meet while attending school full-time.

Some students sacrifice their physical and emotional health for financial stability because juggling work and school is difficult. Others feel hopeless as their debt grows without a clear repayment plan after graduation.

Financial pressures caused by rising inflation are worsening a student mental health crisis. This emphasizes the need for institutions, policymakers, and society to address inflation’s root causes and support those suffering from it.

Next, we’ll examine these students’ emotional struggles to understand better how to help them.

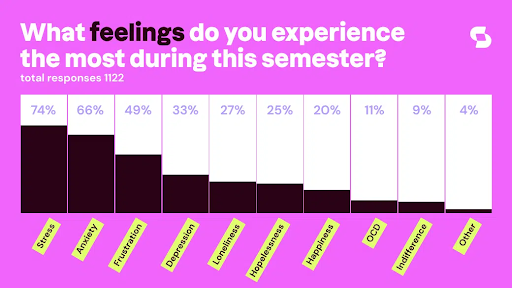

Emotional experiences of students (stress, anxiety, frustration)

Young scholars are increasingly overwhelmed by financial stress, anxiety, and frustration, making them question their ability to continue their education.

Every inflation spike adds to their worries, causing stress from balancing work-study jobs, demanding course loads, anxiety from uncertain job prospects, and rising tuition and necessities.

These emotions can lead to decreased motivation, difficulty concentrating, and social withdrawal, hurting academic performance.

Students may doubt their ability to overcome these challenges when faced with them daily. Institutions and society must confront these issues and support our future leaders at this critical stage.

Student mental health has suffered from the COVID-19 pandemic and rising inflation

Student mental health has suffered from the COVID-19 pandemic and rising inflation.

Comparing the effects of these two crises will show which has had the most significant impact on students’ well-being and highlight the urgent need for solutions that address both issues.

Understanding and addressing these issues can ensure students have a supportive academic and emotional environment.

Comparing the impact of inflation to that of COVID-19 on students’ mental health

Both skyrocketing inflation and COVID-19 heavily impact students’ emotional experiences. Examining both factors is essential to understand the scope of the current student mental health crisis.

The pandemic has led to a significant shift in education practices, with remote learning causing increased isolation, anxiety, and stress among students.

Adding inflation into the mix, which makes it harder for them to afford necessities, creates an incredibly challenging environment for young people navigating their education.

While COVID-19 has significantly worsened student mental health, skyrocketing prices can exacerbate or introduce new issues.

Financial strain may lead some students to work more hours or drop out due to financial pressures. In addition, uncertainty about prospects makes it difficult for them to focus on their studies and maintain a healthy mental state.

As we examine this issue further, let’s explore the immediate consequences of inflation for students as they grapple with these unprecedented challenges.

Immediate consequences of inflation for students

You’re witnessing firsthand the ripple effects of soaring prices on students as they grapple with mounting financial stress and its repercussions on their well-being.

Unfortunately, inflation is causing many immediate consequences for students, making it increasingly difficult to focus on their education and maintain a healthy mental state.

Some of the most pressing concerns include:

- Rising rent prices

- More expensive groceries and necessities

- Higher interest rates

- Longer repayment periods

These factors exacerbate many students’ struggles, such as balancing schoolwork with part-time jobs or internships to make ends meet.

As they struggle to cope with these financial challenges, it’s no surprise their mental health takes a hit.

In times like these, institutions and support networks must help in any way they can. This could include flexible tuition payment plans or increased campus mental health resources.

In addition, you can improve students’ well-being and academic success by easing inflation’s immediate burdens.

Students’ lower spending power affects their lives

- Due to reduced spending power, students stress financially outside of class

- Students struggle to survive with rising inflation

- They must cut food, housing, and transportation while studying

- Academic and financial pressures harm students’ mental health

- Academic stress is high, but budgeting and resource allocation can increase anxiety

- Even buying coffee between classes can make students feel guilty about money

- Financial instability makes saving and using savings to pay for expenses difficult. For example, inflation reduces savings, making rent and tuition more difficult

- Student jobs are scarce and pay low, making it hard to make extra money while studying.

Students may struggle to meet basic needs, affecting student mental health

Debt and despair may result from not saving money, and inadequacy and hopelessness can affect well-being.

Inflation worsens student mental health, and educational institutions and policymakers must recognize the impact on young adults striving for success.

Students can overcome these challenges with support but must learn how to budget in an uncertain economy. This crucial skill will determine which areas need cutbacks, like groceries or online shopping, helping students survive and thrive in these turbulent times.

According to a recent survey, 65% of college students cut these expenses due to the economy.

Many hope to weather skyrocketing inflation and its mental health effects by tightening their belts and making small sacrifices.

To cut back, students buy store brands instead of name brands, buy in bulk, and meal plans to reduce waste and costs; online shopping, they set strict budgets for non-essential items and use price comparison tools or browser extensions to find savings or cashback opportunities; and entertainment subscriptions, they cancel or downgrade memberships or share streaming accounts with friends to split the cost.

These young adults’ financial resourcefulness is admirable. However, students’ long-term concerns must be considered, as college students need systemic financial relief. However, spending less may help temporarily.

Long-term concerns for students

Skyrocketing inflation affects students’ immediate financial situations and has lasting consequences for their future.

The rising cost of living impacts their ability to save money and invest in education, making financial stability harder to achieve post-graduation.

This financial strain can have a domino effect on mental health and overall well-being, leading to anxiety, depression, and burnout, which may affect academic performance, social relationships, and personal development.

In addition, inflationary pressure pushes students to take out larger loans or work multiple jobs, exacerbating mental health issues and prolonging the time needed for educational success or career advancements.

With all these factors colliding, it’s crucial for you as a student now more than ever to address these long-term concerns by understanding how skyrocketing inflation directly impacts your future financial situation and increased study debt.

Future financial situation and increased study debt

Students struggle to manage growing study debt and the rising cost of living.

Inflation strains tight budgets, raising concerns about paying off loans after graduation and taking on more debt while in school.

As students balance financial pressures with good grades and extracurricular activities, this uncertainty can cause stress and anxiety, affecting mental health.

Students need to realize that they’re not alone in facing these challenges, and friends, family, and campus counselling services can help them.

This crisis will likely continue into the job market, affecting how quickly and easily students can find jobs to pay off student loans and build financial security.

This crisis may continue into the job market, affecting how quickly and easily you can find work to pay off student loans and secure your financial future.

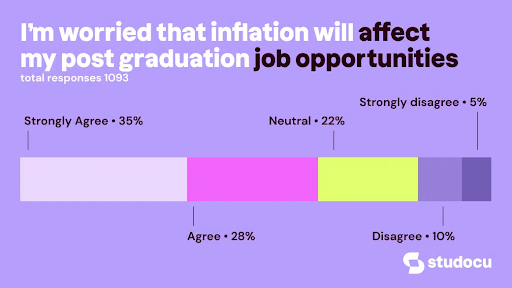

Impact on post-graduation job opportunities

Navigating the job market after graduation can feel like traversing a treacherous mountain pass, as the financial pressures of study debt and economic instability cast a shadow over your career prospects.

Skyrocketing inflation only adds to this stress, as it impacts not just the cost of living but also the availability and quality of job opportunities.

Companies may be less likely to hire new employees due to higher operational costs, while those might offer lower starting salaries or fewer benefits.

As you consider your post-graduation options in this challenging environment, keep in mind some potential consequences:

- A more competitive job market with fewer available positions

- Lower starting salaries make it harder to pay off student loans

- Limited opportunities for growth within companies due to budget constraints

- The need for additional education or certifications to stand out in a crowded field

Despite the obstacles, fear should not dictate young people’s decision-making

Instead, stay proactive by networking with professionals in your chosen industry, gaining relevant experience through internships or volunteer work, and staying informed about trends affecting job seekers and employers.

Remember that even during difficult times, opportunities still exist for those willing to adapt and think creatively.

While soaring inflation and its impact on post-graduation job opportunities may cause anxiety, there’s reason for hope.

As economies adjust and recover from current challenges, businesses will once again seek talented individuals who can contribute positively to their organizations’ success.

Embrace this period as an opportunity for personal and professional growth, and look forward with optimism toward 2023, when things may begin taking a turn for the better.

Optimism for 2023

Scholarships, flexible work arrangements, and economic forecasts can help students cope

Despite rising inflation and its effects on student mental health, 2023 holds hope and positivity. Scholarships, flexible work arrangements, and economic forecasts can help students cope during these challenging times.

However, maintaining a positive outlook while preparing for future success and resiliency in the face of adversity are lifelong skills.

College and university students surveyed expressed hope and uncertainty for 2023. However, they think new policies could lower inflation and stabilize the economy.

Worries about pandemics or unexpected events temper optimism.

While it’s hard to determine a 2023 average rating, students seem cautiously optimistic about solutions or coping mechanisms.

Compared to 2023, when skyrocketing inflation worsens student mental health crises, students from 2021 were still navigating through many challenges that tested their resilience.

Online learning transition: Students had to adapt quickly to online learning platforms, bringing technological and motivational obstacles.

Financial stress: With many families facing job losses or reduced incomes during the pandemic, financial stress began to affect students’ mental health.

Social isolation: The lack of in-person interactions with friends and classmates made many students feel lonely and disconnected from their support network.

The impact of inflation on student mental health cannot be ignored

Skyrocketing inflation has undoubtedly contributed to this decline in mental well-being. As a result, addressing these issues is crucial for the future of education and student success.

Financial pressures increase stress levels, anxiety, and depression among college students struggling with academic demands and adapting to new environments.

By tackling inflation head-on, governments and educational institutions can help alleviate some of this burden on students’ minds.

Taking steps towards controlling inflation will not only benefit students financially but also contribute to improving their overall mental health.

With fewer financial concerns, they can focus more effectively on their studies and personal growth during their higher education.

This opens up opportunities for a brighter future for students in 2023 as they graduate into a world where they feel better equipped mentally and emotionally to face its challenges.

This piece was written and provided by Studocu.