According to the Institute for Fiscal Studies, graduates will now be expected to pay up to 12% student loan interest rate

The IFS has labelled the next few months as an “interest rate rollercoaster” for UK students and graduates.

Labour MP for Leeds, Richard Burgon tweeted his disgust for the rapid increase, arguing it was time to talk about writing off student dept all together.

Student loan interest rates will hit 12% in September.

The current situation just can't go on.

It's time not just to scrap university fees but for a serious national conversation about writing-off student debt.

— Richard Burgon MP (@RichardBurgon) April 13, 2022

High-earning graduates will incur ~£3,000 in interest over six months

According to the IFS, the current retail price index (RPI) shows that unless policy changes are enacted, then there will be some significant changes:

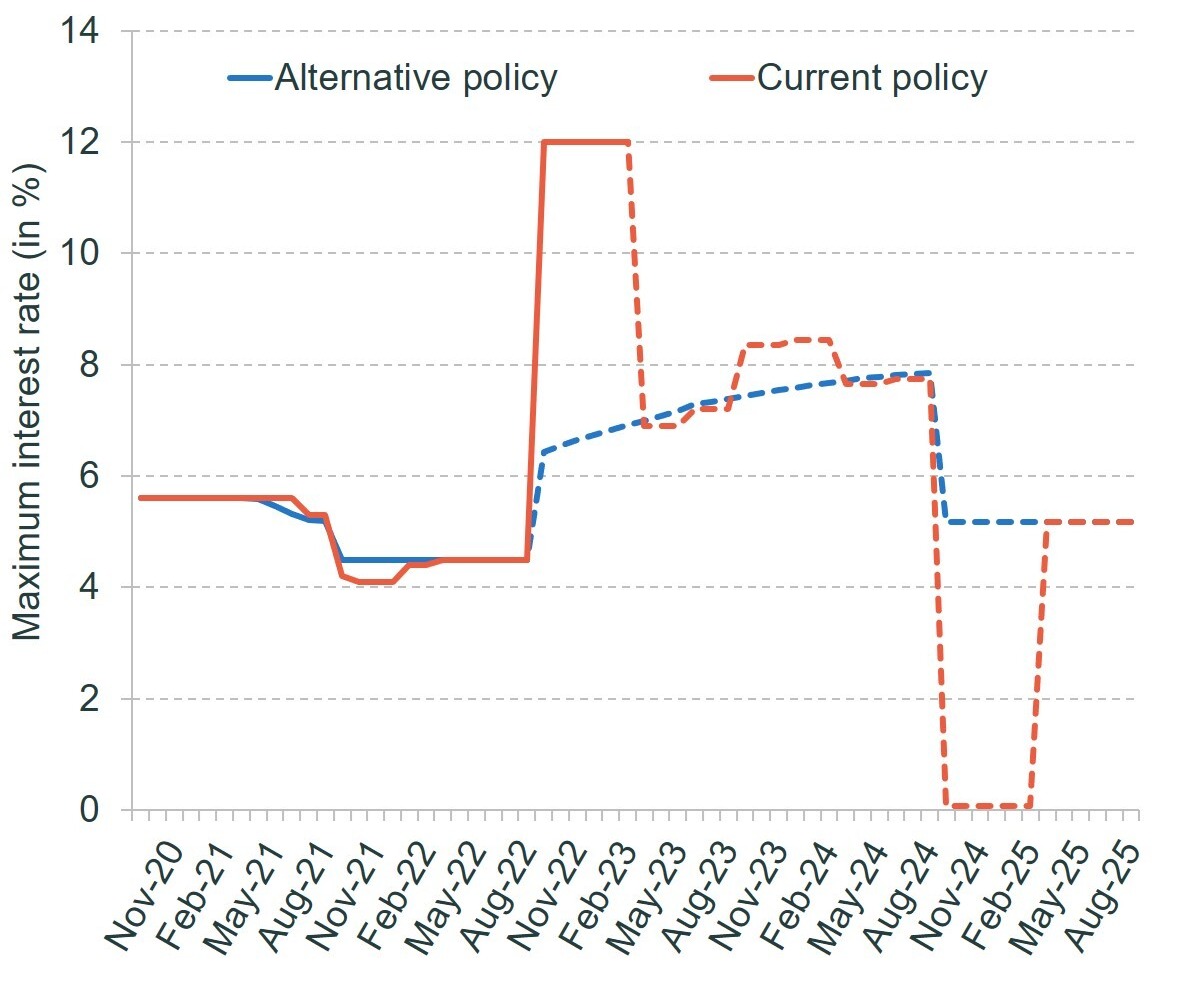

- The maximum interest rate (charged to lose earning £49,130 or more) will rise from its current level of 4.5% to an excessive 12% for half a year

- The interest rate for lower earners will rise from its current level of 1.4% to 9%

These numbers reveal that on a typical loan balance of £50,000, a high-earning graduate would incur around £3,000 in interest over just six months. This is more than someone earning three times the median salary for recent graduates would usually repay during that time.

Source: Office for Budget Responsibility; Department for Education; author’s calculations.

Changed rates are expected to last until atleast 2025

According to the maximum student loan interest rate is then likely to fall to around 7% in March 2023 and fluctuate between 7 and 9% for a year and a half; in September 2024, it is then predicted to fall to around 0% before rising again to around 5% in March 2025.

The combination of high inflation and interest rate cap that takes around half a year to come into place. Without the cap – maximin interest rates would be 12% and would continue throughout 2022/23 academic year, and 13% in 2023/24.

While interest rates affect all borrowers’ loan balances, they only affect actual repayments for the typically high-earning graduates that will pay off their loans.

The potential long term problems of student loan interest rates

The extent of the impact that student loan interest rates will have on graduates is hard to define at the moment.

Because picking up my phone seeing student loan interest rises, in the same month our NI rises, in the same month our energy bills go up 54%, in the same month inflation goes up 7%, in the same month VAT in hospitality goes up 20% has pushed me over the edge

— MXM (@mxmsworld) April 13, 2022

Along with this, sky-high interest rates may put some prospective students off going to university. Some graduates will likely feel compelled to pay off their loans – even when this has no benefit for them.